Keeping Current with Tax and Accounting Services

February 20, 2014Planning Ahead

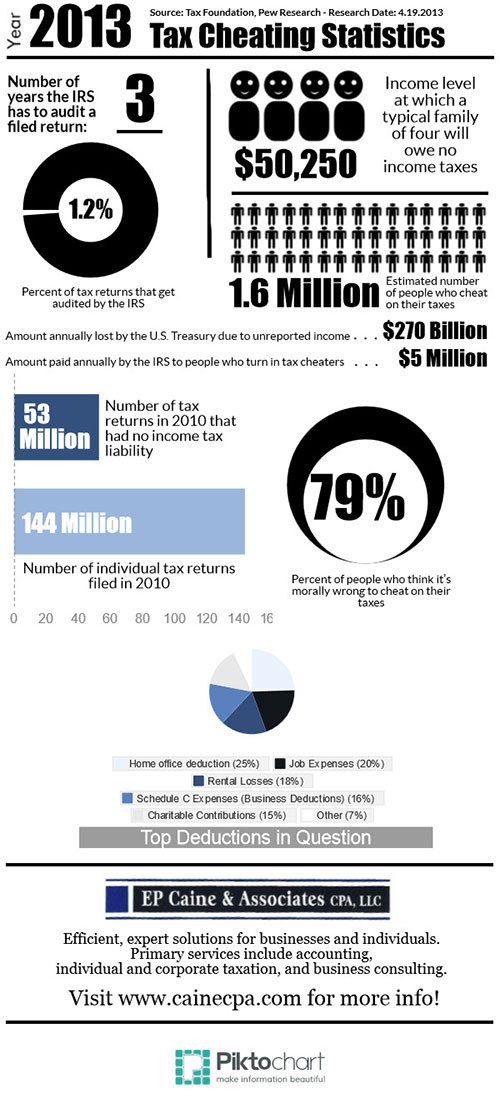

October 16, 2014Tax Cheating Statistics

With an estimated 1.6 million people who cheat on their taxes, it may come as a surprise that only a small percentage of taxpayers are convicted of tax crimes every year. In fact, the number of convictions for tax crimes has decreased over the past decade.

According to the Tax Foundation, Pew Research, 79% percent of people think that it is morally wrong to cheat on their taxes. According to the IRS, individual taxpayers do 75% of the cheating – mostly middle-income earners.

So how do people cheat on their taxes? Most people deliberately underreport income. This is called tax evasion. Others, self-employed taxpayers, for instance, over-deduct business-related expenses. Top deductions in question are: home office deduction, job expenses, rental losses, schedule c expenses (business deductions), and charitable contributions. Some don’t report their gambling winnings, which is against the law. A few have fabricated a dependent. However, auditors are trained to look for tax fraud. If you’re caught cheating, you might end up with civil fines, penalties or worse.

Hiring a professional accountant can take much of the stress out of completing your taxes. The software and programs that accountants use are typically far more sophisticated than the products available to consumers. Additionally, tax professionals can often provide valuable advice and suggestions based on their knowledge of your finances and family.

A professional tax preparer is so familiar with the system; he can easily accomplish tasks that might take skilled taxpayers hours of research. Even if your tax situation is straightforward, hiring a professional can save you the time and stress of sorting through taxes on your own.

EP Caine & Associates specializes in tax and accounting services. For more information, contact the firm at (610) 525-2933 or fill out our contact form here to email us directly.